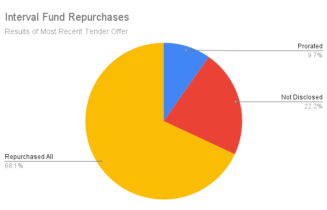

Interval Funds Monthly- March 2024

This month five new interval fund filed registrations statements: Fund Name Strategy Registration Date The Pop Venture Fund PE/VC 3/29/2024 Axxes Opportunistic Credit Fund Credit 03/15/2024 Cascade Private Capital Fund PE/VC 03/14/2024 Accordant Real Estate Growth Fund Real Estate 03/07/2024 John Hancock Multi Asset Credit Fund Credit 03/06/2024 Other notable fund registrations include a new […]