Unlisted CEFs: Key Asset Growth and Fund Launch Trends Continue in 2024

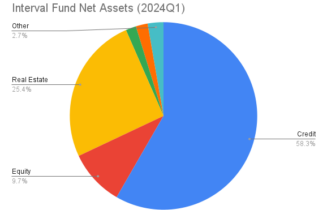

Unlisted closed end funds(CEFs) are continuing their rapid growth in 2024. As of the most recent SEC filings, there are a total of $75.3 billion net assets in interval funds, and $60.9 billion net assets in tender offer funds. Year over year net asset growth is 19.3% for interval funds, and 20.3% for tender offer […]