Interval Funds Monthly- January 2024

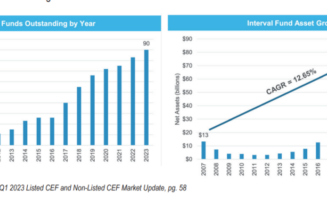

Two new interval funds filed registration statements in January 2024: Catalyst Strategic Income Opportunities Fund, and Fidelity Floating Rate Opportunities Fund. Additionally, the Meketa Infrastructure Fund, which filed an initial registration statement in September 2023, was declared effective by the SEC in January. Catalyst Strategic Income Opportunities Fund Catalyst Strategic Income Opportunities Fund filed a […]